Stockport Property Investment: Best Buy-to-Let Areas 2025

Stockport combines its strategic location within Greater Manchester with a large property market, providing entry level housing for homeowners and buy-to-let investors, with a real estate market that has all the hallmarks of continued growth, including population increases, proximity to affluent Manchester suburbs and amazing employment and transport links.

So for yield-focused investors, Stockport seems to tick all the boxes on the investment property checklist. In this article we look at exactly why and the benefits of the stockport housing market for landlords.

Data updated: February 2025. Next update: April 2025

Stockport Buy-to-Let Market Overview 2025

Average yields range from 3.30% to 5.50%, with property prices spanning £209,592 to £484,112. Top performing areas include SK1 and SK5 for yields (5.50%) and SK7 for capital growth. With average weekly rents between £220-£315, equivalent to monthly rents of £954-£1,366.

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. Next update: April 2025. All data is presented as provided by our sources without adjustments or amendments.

Best Areas for Buy-to-Let in Stockport

Highlights

Stockport is perfectly positioned in Greater Manchester with the affluent suburb of Didsbury to the west, luxury homes in Cheshire to the south and rural appeal of the Peak district to the East. It offers entry level and high-end luxury buy-to-let opportunities across its eight postcode districts, balancing yield potential with strong capital growth prospects.

Average for sale house prices £

- Premium areas: SK7 (Bramhall) leads at £484,112, with SK8 (Cheadle) at £418,811

- Mid-range areas: SK6 (Bredbury) at £376,066 and SK4 (Heaton Moor) at £372,494

- Value opportunity: SK1 (Town Centre) at £209,592 represents the most accessible entry point

Average rents and yields

- Highest weekly rent: SK8 (Cheadle) achieves £322, delivering a 4.00% yield

- Top yield areas: SK1 (Town Centre) and SK5 (Reddish) both lead with 5.50% yield

- Premium yield: SK7 (Bramhall) offers 3.40% due to higher purchase prices

Stockport's property market significantly benefits from Manchester's extensive road and rail network, with direct links to London and talk of new local Metro link connections via neighbouring areas. The town's strategic position and ongoing regeneration make it particularly attractive for those seeking affordable value in Greater Manchester's expanding property market, with some areas already rivalling Manchesters most expensive homes and streets.

Why Invest in Stockport?

Stockport is a town and borough in Greater Manchester, North West England. It is historically part of the county of Cheshire and is administered by Stockport Metropolitan Borough Council. Stockport was traditionally a textile manufacturing town and was once the country's largest centre for hat-making. Today, Stockport is a key driver of the Greater Manchester economy, with a bold plan for a £1 billion regeneration.

Stockport's economy provides the 3rd largest workforce in Greater Manchester across 13,000 businesses and a workforce of 124,000 people, plus 99,000 students across 4 universities.

Stockport has excellent transport links to Manchester and the rest of the UK. The M60 motorway and the A6 serve the town, and Stockport Train Station is on the West Coast Main Line, with direct services to Manchester, Birmingham, and London Euston. Manchester Airport is just five miles southwest of the town centre.

This incredible foundation is why Stockport is such a popular place for buy-to-let landlords and developers looking to add value with buy-refurbish-refinance strategies and house flipping.

Stockport Buy-to-Let Market Analysis 2025

When Was the Last House Price Crash in Stockport?

House price trends vary across Stockport postcode districts with some areas experiencing faster growth than others. However, the overall trend for house prices in Stockport has seen rapid growth since 2010.

The last significant property price crash in Stockport occurred during the global financial crisis of 2008-2010, which happened after a large growth period of house prices between 2000 - 2007.

In 2021 to 2022 the stockport real estate market saw a small dip in prices, but that recovered quickly and has continued growing, so any house price crash at this time was short lived.

Average Sold House Prices in Stockport by Property Types

The latest sold house price index by the land registry, Nov 2024 (it is always a couple of months behind reporting its datasets), shows the following average sold house prices across the Stockport local authority area.

Stockport's property prices demonstrate strong value compared to UK averages, particularly in the detached housing sector where prices exceed the national average by 15%. The semi-detached market also shows robust performance at 13% above UK averages, while flats and maisonettes offer more accessible entry points at 24% below national averages. This could indicate significant affordable value in the local market for apartments.

Stockport Sold House Prices (local authority area)

Updated February 2025

| Property Type | Stockport Average Price | UK Average | Difference |

|---|---|---|---|

| Detached houses | £501,471 | £436,949 | +15% |

| Semi-detached houses | £320,879 | £283,546 | +13% |

| Terraced houses | £233,798 | £242,598 | -4% |

| Flats and maisonettes | £176,976 | £233,230 | -24% |

| All property types | £300,139 | £289,707 | +4% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. Next update: April 2025. All data is presented as provided by our sources without adjustments or amendments.

House Prices in Stockport: For Sale Asking Prices (£)

Updated February 2025

The data represents the average asking prices of properties currently listed for sale in Stockport.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | SK7 (Bramhall) | £484,112 |

| 2 | SK8 (Cheadle) | £418,811 |

| 3 | SK6 (Bredbury) | £376,066 |

| 4 | SK4 (Heaton Moor) | £372,494 |

| 5 | SK2 (Edgeley) | £320,636 |

| 6 | SK3 (Davenport) | £280,506 |

| 7 | SK5 (Reddish) | £234,987 |

| 8 | SK1 (Town Centre) | £209,592 |

Stockport's property market shows substantial variation in prices across different areas. The affluent suburb of Bramhall (SK7) leads with average prices of £484,112, followed by Cheadle (SK8) at £418,811. The town center (SK1) offers the most accessible entry point at £209,592. These figures represent average prices across all property types, and actual prices can vary significantly based on property size, condition, and specific location within each postcode district.

Price Per Square Foot in Stockport (£)

Updated February 2025

The data represents a blended average, combining the average asking price per square foot of properties currently for sale in Stockport and the sold price per square foot of sold properties.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | SK7 (Bramhall) | £363 |

| 2 | SK4 (Heaton Moor) | £348 |

| 3 | SK6 (Bredbury) | £322 |

| 4 | SK2 (Edgeley) | £290 |

| 5 | SK3 (Davenport) | £285 |

| 6 | SK5 (Reddish) | £266 |

| 7 | SK1 (Town Centre) | £244 |

Stockport's price per square foot values show significant variation across the borough, with Bramhall (SK7) commanding the highest at £363 and Heaton Moor (SK4) following at £348 per square foot. The more suburban areas generally show higher values, while areas closer to the town center show lower prices per square foot. These figures reflect the average across all property types and should be considered alongside factors such as building age, condition, and specific location within each postcode.

House Price Growth in Stockport (%)

Updated February 2025

The data represents the average house price per square foot growth over the past five years, calculated using a blended rolling annual comparison of both sold prices and asking prices. These figures should be interpreted with caution, as they reflect average prices across all property types and include both properties currently for sale and those already sold.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | SK1 (Town Centre) | 42.00% |

| 2 | SK4 (Heaton Moor) | 32.20% |

| 3 | SK3 (Davenport) | 28.50% |

| 4 | SK2 (Edgeley) | 28.20% |

| 5 | SK6 (Bredbury) | 27.20% |

| 6 | SK5 (Reddish) | 23.60% |

| 7 | SK8 (Cheadle) | 22.80% |

| 8 | SK7 (Bramhall) | 21.50% |

Stockport's growth figures show notable variation across different areas, with the Town Centre (SK1) leading at 42.00%, followed by Heaton Moor (SK4) at 32.20%. These figures should be viewed with some caution as they represent average prices across all property types and include properties 'for sale' and 'sold prices'. The data suggests particularly strong growth in traditionally more affordable areas, with three postcodes showing growth above 28%. Meanwhile, areas like Bramhall (SK7) and Cheadle (SK8) show more modest but still positive growth rates above 21%.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. Next update: April 2025. All data is presented as provided by our sources without adjustments or amendments.

Stockport Buy-to-Let Rental Market Analysis

For those buying their first rental property, and thinking how much can you charge for rent in Stockport?

The rental demand in Stockport for years has been really strong, across all property and tenant types. Partially due to the city's growing population and partially due to affluent surrounding areas.

The rental data below gives an indication on the rental income per month and the rental yields landlords can aim to achieve for traditional assured shorthold tenants. This is helpful if you are preparing to become a landlord in the Stockport area.

Rental Prices in Stockport (£)

Updated February 2025

The data represents the average monthly rent for long-let AST properties in Stockport. These figures reflect rents across all property types and do not account for differences in property size, number of bedrooms, or short-term lets.

| Rank | Area | Average Weekly Rent | Average Monthly Rent |

|---|---|---|---|

| 1 | SK8 (Cheadle) | £323 | £1,399 |

| 2 | SK7 (Bramhall) | £315 | £1,366 |

| 3 | SK6 (Bredbury) | £285 | £1,235 |

| 4 | SK3 (Davenport) | £284 | £1,231 |

| 5 | SK2 (Edgeley) | £271 | £1,174 |

| 6 | SK5 (Reddish) | £250 | £1,084 |

| 7 | SK4 (Heaton Moor) | £238 | £1,031 |

| 8 | SK1 (Town Centre) | £221 | £958 |

Stockport's rental market shows notable variation across different areas, with Cheadle (SK8) and Bramhall (SK7) achieving the highest average weekly rents at £323 and £315 respectively. The suburban areas with housing stock including larger properties including detached and semi-detached houses generally command higher rents, while the central areas show lower average rents. Remember these figures represent average rents across all property types, from studio apartments to larger houses, and actual achievable rents can vary significantly based on property size, condition, and specific location.

Gross Rental Yields in Stockport (%)

Updated February 2025

The data represents the average gross rental yield in Stockport, calculated using a snapshot of current properties for sale and properties for rent. These figures are based on asking prices.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | SK1 (Town Centre) | 5.50% |

| 2 | SK5 (Reddish) | 5.50% |

| 3 | SK3 (Davenport) | 5.30% |

| 4 | SK2 (Edgeley) | 4.40% |

| 5 | SK8 (Cheadle) | 4.00% |

| 6 | SK6 (Bredbury) | 3.90% |

| 7 | SK7 (Bramhall) | 3.40% |

| 8 | SK4 (Heaton Moor) | 3.30% |

Stockport's rental yields show notable variation across different postcodes, with the Town Centre (SK1) and Reddish (SK5) offering the highest yields at 5.50%, followed by Davenport (SK3) at 5.30%. These areas typically have lower property prices combined with steady rental demand. These figures represent gross rental yields calculated from average rents and prices, and investors should note that net yields will be lower after accounting for costs, void periods, and management expenses.

Access our selection of exclusive, high-yielding, off-market property deals and a personal consultant to guide you through your options.

Is Stockport Rent High?

Yes, Stockport's rental costs represent a notable financial commitment for residents relative to local earnings, albeit not as high as nearby Manchester and parts of Cheshire.

Based on ONS data showing North West median weekly household income at £696 (£36,192 annually), Stockport's rental costs consume a significant portion of local earnings.

In Cheadle (SK8), which has Stockport's highest weekly rents at £323 (£1,399 monthly), residents need to commit a staggering 46.4% of their gross income to rent. The situation is similar in Bramhall (SK7), where weekly rents of £315 (£1,366 monthly) would require 45.3% of the median household income.

Even in more affordable areas like the Town Centre (SK1), where weekly rents average £221 (£958 monthly), residents still need to commit 31.7% of median household income to rent. Suburban locations like Bredbury (SK6) show consistently high rental rates at £285 per week (£1,235 monthly), requiring around 40.9% of median gross household income.

While Stockport's rental prices generally sit below neighbouring Manchester's levels, the reality for local residents is that housing costs consume a substantial share of their income. With most areas requiring between 31-46% of median gross household income for rent - before tax, utilities, and other living expenses - Stockport's rental market presents significant affordability challenges for its residents, particularly in the more affluent suburban areas where larger properties command higher rents making it difficult for families (both owner occupiers and tenants).

Are Stockport House Prices High?

Stockport's property market shows strong performance compared to the wider UK market, with HM Land Registry House Price Index data showing sold house prices generally above national averages across most property types.

Stockport's average sold property price of £300,139 sits 3.6% above the UK average of £289,707.:

The asking prices for properties in Stockport right now (properties that are actively on the market for sale rather than actual sold prices noted above) vary widely across postcodes, from Bramhall (SK7) at £484,112 and Cheadle (SK8) at £418,811, down to more affordable areas like Town Centre (SK1) at £209,592 and Reddish (SK5) at £234,987.

Yet with median annual earnings in the North West at £36,192 (£696 weekly), Stockport's most affordable areas require around 5.8 times annual salary, while the more affluent suburbs like Bramhall exceed 13.4 times the median regional wage if you wanted to buy a buy-to-let based on current values.

Even traditionally more affordable areas like Edgeley (SK2), where prices average £320,636, still require around 8.9 times the regional median salary - exceeding typical mortgage lending limits of 4-4.5 times household income.

The higher entry prices compared to other major North West towns has recently made it unaffordable for the average homeowner and buy-to-let landlords.

Those looking for more affordable homes have started to look further afield including nearby, Oldham, Warrington and even Chester.

How Much Deposit to Buy a House in Stockport?

Assuming a 30% deposit for the average buy-to-let investor, here's an overview of deposit requirements across different Stockport regions:

North Stockport

- SK5 (Reddish): A buy-to-let investor looking at an average property (£234,987) would need to put down a 30% deposit of £70,496, with yields at 5.50%.

- SK6 (Bredbury): In Bredbury, an investor would need a 30% deposit of £112,820 for an average property (£376,066), achieving a yield of 3.90%.

South Stockport

- SK7 (Bramhall): A buy-to-let investor would need a 30% deposit of £145,234 for an average property (£484,112), with a yield of 3.40%.

- SK8 (Cheadle): In Cheadle, an investor would need a 30% deposit of £125,643 for an average property (£418,811), offering a yield of 4.00%.

Central Stockport

- SK1 (Town Centre): A buy-to-let investor would need a 30% deposit of £62,878 for an average property (£209,592), with yields at 5.50%.

- SK2 (Edgeley): An investor would require a 30% deposit of £96,191 for an average property (£320,636), achieving a yield of 4.40%.

- SK3 (Davenport): For an average property in Davenport (£280,506), a deposit of £84,152 would be needed, offering a yield of 5.30%.

- SK4 (Heaton Moor): In Heaton Moor, an investor would need a 30% deposit of £111,748 for an average property (£372,494), with yields at 3.30%.

For those considering how to start a property business, areas like Town Centre (SK1) and Reddish (SK5) offer an excellent balance of affordable entry prices and solid yields above 5%, while maintaining good transport links to Manchester making it very appealing to tenants.

Stockport Population Growth

The total population of Stockport was 294,800 (as of the last UK government census in 2021).

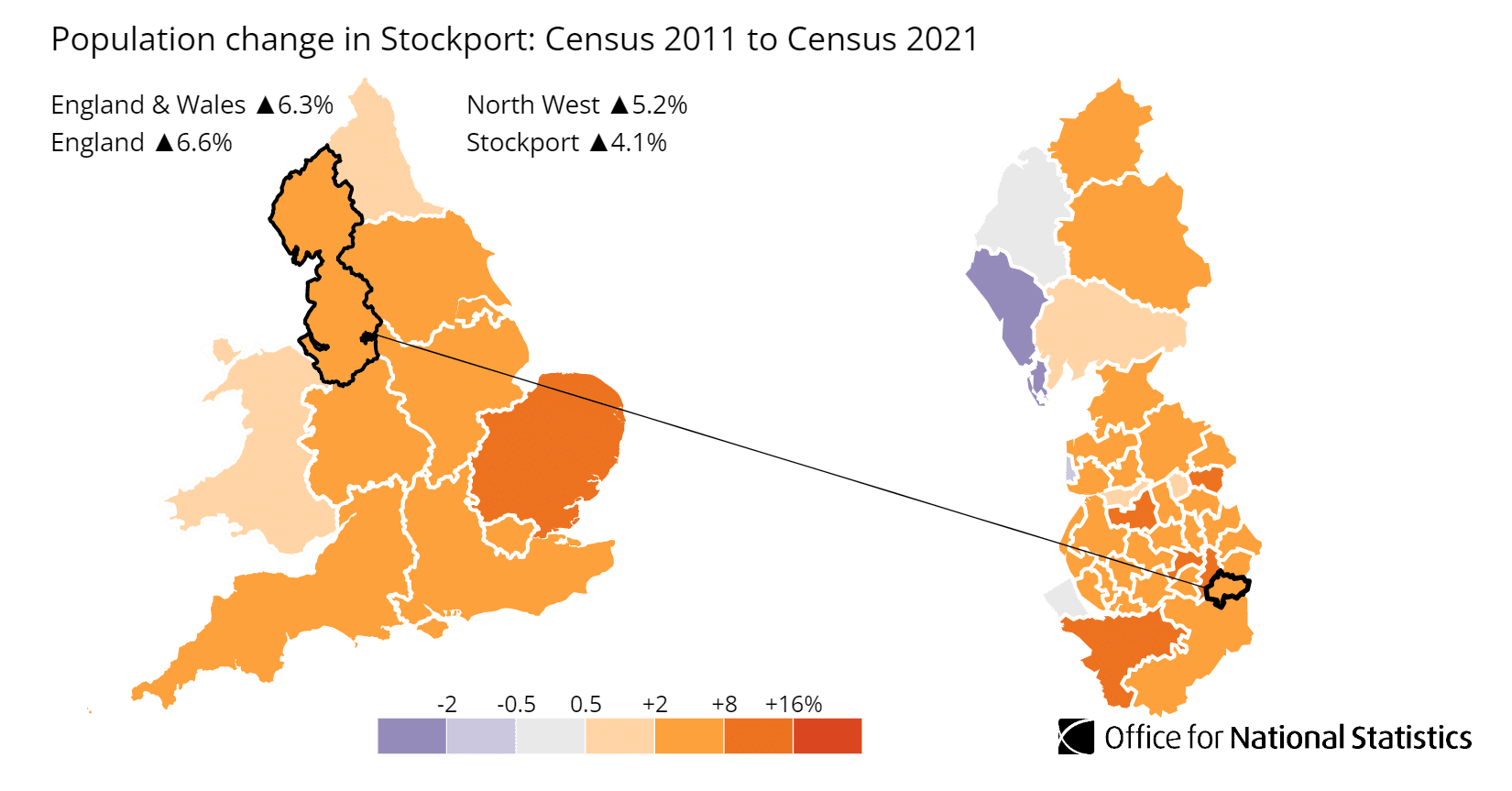

Stockport's population has grown by 4.1%, increasing from 283,300 in 2011.

This growth rate was lower than both the overall population increase across the North West region (5.2%) and England's overall growth (6.6%).

The average (median) age in Stockport increased by one year to 42 years between the two censuses. This indicates an older demographic profile compared to both the North West region and England overall, which both had median ages of 40 years.

Notable age-related changes in Stockport's population between 2011 and 2021 include:

- The number of residents aged 65-74 years increased by over 4,400 people (a 16.7% rise)

- The 35-49 age group decreased by around 3,100 people (a 4.9% reduction)

- The proportion of residents aged 50-64 remained stable at around 19.9% of the population

Population density in Stockport has also increased, with the area now home to approximately 16.7 people per football pitch-sized piece of land, up from 16.0 in 2011. This places Stockport among the top 30% most densely populated English local authority areas.

Of particular interest to landlords, private renting has increased significantly:

- 14.4% of Stockport households now rent privately (up from 11.4% in 2011)

- 13.3% live in social rented housing (slightly down from 13.6% in 2011)

- Home ownership has decreased from 73.2% to 71.1%

Below we look at the largest postcode districts by population across Stockport and the population growth for each.

Population Growth in Stockport by Postcode District

Population and growth rates by area (2021 Census data)

| Rank | Area | Population at 2021 Census | Population Growth 2011 to 2021 |

|---|---|---|---|

| 1 | SK8 (Cheadle) | 58,396 | 5% |

| 2 | SK6 (Bredbury) | 50,689 | 5% |

| 3 | SK7 (Bramhall) | 40,669 | 5% |

| 4 | SK4 (Heaton Moor) | 34,510 | 5% |

| 5 | SK5 (Reddish) | 29,538 | 5% |

| 6 | SK2 (Edgeley) | 29,451 | 5% |

| 7 | SK3 (Davenport) | 27,923 | 5% |

| 8 | SK1 (Town Centre) | 11,230 | 5% |

The population data shows consistent growth across Stockport's postal districts, with all areas experiencing a 5% increase over the past decade. SK8 (Cheadle) and SK6 (Bredbury) are the most populous districts, each home to over 50,000 residents. The population distribution shows a clear pattern, with suburban districts having larger populations than central areas. Even the smallest district by population, SK1 (Town Centre) with 11,230 residents, maintained steady growth at 5%, indicating stable development across the borough. Note: While the postcode district data totals 282,406 residents, Stockport's total population is 294,800. This difference occurs because some postcode districts cross local authority boundaries and are not included in the district-level breakdown.

Stockport Landlord Licensing

Buy-to-Let Licensing

For Stockport buy-to-let landlords with traditional individual or family tenants, there currently isn't a mandatory, selective or additional landlord licensing scheme in place across Stockport.

Houses of Multiple Occupation Licensing

Landlords who want to invest in a HMO (house in multiple occupation) in Stockport are likely to need a mandatory licence. This is currently a requirement for all HMOs with:

- 5 or more people

- From 2 or more households

- Who share facilities (such as bathrooms or kitchens)

Current Stockport HMO Licensing Fees (as of February 2025):

- New HMO licence (up to 5 bedrooms): £1,115 (£780 application fee + £335 grant fee)

- Licence renewal: £950 (£665 application fee + £285 grant fee)

- Additional rooms above 5 bedrooms: £35 per room

- Pre-licence application advice: £375

Licenses are valid for 5 years from the date of issue. Stockport council HMO requirements can be found here.

Stockport Article 4 Directions

Stockport has extensive Article 4 directions in place across 24 conservation areas, which means you need planning permission to change a house from a traditional buy-to-let home (classed as a C3 dwelling house) to a HMO (classed as a C4 house in multiple occupation).

Key conservation areas with Article 4 directions include:

- Cheadle Village

- Davenport Park

- Heaton Moor

- Bramhall Park

- Cale Green

For detailed planning requirements or to check if a property falls within an Article 4 area, landlords should consult Stockport Council's planning portal or their Historic Environment Database maps.

How to Invest in Buy-to-Let in Stockport

For properties to buy in Stockport including:

- Finding off-market properties

- Buy-to-lets

- Buying a Holiday let or Serviced accommodation

- HMOs (houses of multiple occupation)

- PBSA (purpose built student accommodation)

- and other high yielding opportunities

We have partnered with the best property investment agents we can find for 8+ years.

Here you can get access to the latest investment property opportunities from our network.

For more information about specific areas:

- If you're interested in the highest returns, consider SK1 (Town Centre) and SK5 (Reddish) with yields of 5.50%

- For alternative options with affordable entry prices, check out our guide to the cheapest areas to live in Manchester

- For different opportunities further afield consider exploring buy-to-let in Preston or buy-to-let in York.