Liverpool Property Investment: Best Buy-to-Let Areas 2025

Liverpool combines its rich maritime heritage with the Royal Albert Dock once a major player in global trade, with a new growing economy now aiming to adopt and become a pioneer in adopting artificial intelligence.

This shift shows how Liverpool's resilient economy has continued to adapt and today offers property investors an opportunity with significantly lower entry prices compared to other major UK cities like buy-to-let in Manchester, buy-to-let in Birmingham and especially London.

While still benefiting from extensive regeneration and strong rental demand for it's growing population.

The city's strategic location in the North West, ongoing transformation through projects like Liverpool Waters and the Knowledge Quarter, plus average property prices 34.8% below the UK average, make it particularly attractive for those seeking value in the UK property cycle.

Data updated: February 2025. Next update: April 2025

Liverpool Buy-to-Let Market Overview 2025

Average sold property prices in Liverpool (£188,744) are 34.8% below the UK average, with rental yields ranging from 3.90% to 7.90% across different postcodes. Premium areas like L38 (Aintree) command higher asking prices (£410,281), while areas like L20 offer stronger yields (7.90%). Weekly rents span from £136 to £176, equivalent to monthly rents of £589 to £763, with significant variation across districts.

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. Next update: April 2025. All data is presented as provided by our sources without adjustments or amendments.

Best Areas for Buy-to-Let in Liverpool

Highlights

Average for sale house prices £

- Premium areas: L38 (Aintree) leads at £410,281, with L37 (Formby) at £377,396 and L18 (Mossley Hill) at £372,441

- Mid-range areas: L12 (West Derby) at £249,663 and L19 (Aigburth) at £253,679

- Value opportunity: L28 (Stockbridge Village) at £117,308 and L4 (Anfield) at £119,309 represent the most affordable entry points

Average asking rents and yields

- Highest weekly rent: L1 (City Centre) achieves £176 per week

- Highest yielding areas: L20 (Bootle) leads with 7.90% yield, followed by L4 (Anfield) at 7.70%

- Lowest yields: L18 (Mossley Hill) offers 4.20% due to higher purchase prices

Why Invest in Liverpool?

Liverpool stands out as a major investment opportunity within the UK property market. Known for it's digital and creative industries, life sciences, healthcare, maritime, logistics and advanced manufacturing to name a few, it attracts a skilled population.

Major Regeneration Projects

Liverpool is undergoing extensive regeneration, with several transformative projects.

The Knowledge Quarter is on track for £2 billion in development aiming to deliver 250,000 square meters of development space, 2,000 jobs and 785 homes.

Liverpool waters is a £5 billion waterfront transformation, creating a 30 year development vision in to a long term sustainable mixed-use district that includes a new 52,000 seat football stadium for Everton FC, Isle of Man ferry dock and significant residential and commercial developments including a 2,350 new homes project.

Liverpool City Region's designation as an Investment Zone is set to generate £320 million in private investment across the region including in nearby Runcorn and St.Helens, to create 4,000 new jobs over five years, and to establish Liverpool as a pharmaceutical production superpower.

Liverpool Purpose Built Student Accommodation

Liverpool's strong university presence creates reliable rental demand with 70,000+ students across three universities, University of Liverpool, Liverpool John Moores University and Liverpool Hope University, creating an increasing demand for purpose-built student accommodation and student houses of multiple occupation.

Liverpool Buy-to-Let Market Analysis 2025

When Was the Last House Price Crash in Liverpool?

The last significant property price crash in Liverpool occurred during the global financial crisis of 2008-2010. Looking at the property data across all types:

- Pre-2008: Steady growth with property prices rising strongly from 2000-2007

- 2008-2010: Substantial market crash

- Transaction volumes collapsed from 1,500-2,000 monthly sales to below 500

- Sharp price corrections across all property types

- Particularly severe impact on higher-value detached properties

- Recovery Timeline:

- 2010-2015: Extended recovery period with static prices

- 2015-2020: Market stability returned with steady growth

- 2020-2024: Strong price appreciation resumed

Unlike some nearby cities like Manchester, Liverpool's property market took longer to recover from the 2008 crash, with prices remaining relatively flat until 2015.

While there have been periods of price moderation since 2008, none have matched the severity of the 2008-2010 crash.

Average Sold House Prices in Liverpool by Property Types

Liverpool's property market offers exceptional value compared to UK averages, with prices significantly below national levels across all property types. This substantial price difference presents attractive opportunities for investors seeking value in a major UK city.

The latest sold house price index by the land registry, Nov 2024 (it is always a couple of months behind reporting its datasets), shows the following average house prices across the Liverpool local authority area:

Liverpool Sold House Prices (local authority area)

Updated February 2025

| Property Type | Liverpool Average Price | UK Average | Difference |

|---|---|---|---|

| Detached houses | £361,066 | £436,949 | -17% |

| Semi-detached houses | £229,990 | £283,546 | -19% |

| Terraced houses | £168,061 | £242,598 | -31% |

| Flats and maisonettes | £141,197 | £233,230 | -39% |

| All property types | £188,744 | £289,707 | -35% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. Next update: April 2025. All data is presented as provided by our sources without adjustments or amendments.

House Prices in Liverpool: For Sale Asking Prices (£)

Updated February 2025

The data represents the average asking prices of properties currently listed for sale in Liverpool.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | L38 (Aintree) | £419,615 |

| 2 | L18 (Mossley Hill) | £386,855 |

| 3 | L37 (Formby) | £371,363 |

| 4 | L40 (Burscough) | £344,214 |

| 5 | L39 (Ormskirk) | £339,090 |

| 6 | L16 (Bowring Park) | £336,545 |

| 7 | L23 (Crosby) | £327,108 |

| 8 | L25 (Belle Vale) | £312,298 |

| 9 | L26 (Halewood) | £286,362 |

| 10 | L31 (Maghull) | £269,436 |

| 11 | L34 (Prescot) | £265,361 |

| 12 | L12 (West Derby) | £259,359 |

| 13 | L17 (Sefton Park) | £254,017 |

| 14 | L19 (Aigburth) | £239,857 |

| 15 | L35 (Rainhill) | £237,555 |

| 16 | L15 (Wavertree) | £213,244 |

| 17 | L36 (Huyton) | £211,830 |

| 18 | L24 (Speke) | £208,785 |

| 19 | L22 (Waterloo) | £208,194 |

| 20 | L10 (Aintree) | £190,149 |

| 21 | L1 (City Centre) | £188,724 |

| 22 | L3 (City Centre) | £187,396 |

| 23 | L8 (Toxteth) | £181,698 |

| 24 | L14 (Broadgreen) | £178,650 |

| 25 | L33 (Kirkby) | £170,586 |

| 26 | L30 (Walton) | £167,232 |

| 27 | L21 (Litherland) | £161,613 |

| 28 | L7 (Edge Hill) | £159,891 |

| 29 | L32 (Kirkby) | £156,051 |

| 30 | L9 (Walton) | £152,272 |

| 31 | L11 (Norris Green) | £150,654 |

| 32 | L5 (Everton) | £146,325 |

| 33 | L13 (Old Swan) | £143,803 |

| 34 | L2 (Commercial District) | £141,791 |

| 35 | L27 (Netherley) | £141,336 |

| 36 | L6 (Anfield) | £132,030 |

| 37 | L4 (Anfield) | £124,813 |

| 38 | L20 (Bootle) | £120,347 |

Liverpool's asking prices show significant variation across different postal districts, with Aintree (L38) commanding the highest average at £419,615 and Bootle (L20) offering more accessible entry points at £120,347. This wide range of price points reflects Liverpool's diverse property market, from premium suburban locations to more affordable urban areas. The variation in prices provides opportunities for investors with different strategies and budgets. Note: These figures represent average asking prices across all property types, and actual achieved prices may vary.

Price Per Square Foot in Liverpool (£)

Updated February 2025

The data represents a blended average, combining the average asking price per square foot of properties currently for sale in Liverpool and the sold price per square foot of sold properties.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | L18 (Mossley Hill) | £296 |

| 2 | L16 (Bowring Park) | £291 |

| 3 | L37 (Formby) | £280 |

| 4 | L25 (Belle Vale) | £278 |

| 5 | L38 (Aintree) | £266 |

| 6 | L40 (Burscough) | £259 |

| 7 | L17 (Sefton Park) | £258 |

| 8 | L1 (City Centre) | £257 |

| 9 | L2 (Commercial District) | £256 |

| 10 | L23 (Crosby) | £254 |

| 11 | L39 (Ormskirk) | £252 |

| 12 | L3 (City Centre) | £247 |

| 13 | L26 (Halewood) | £246 |

| 14 | L19 (Aigburth) | £243 |

| 15 | L31 (Maghull) | £242 |

| 16 | L12 (West Derby) | £232 |

| 17 | L35 (Rainhill) | £223 |

| 18 | L34 (Prescot) | £222 |

| 19 | L22 (Waterloo) | £215 |

| 20 | L8 (Toxteth) | £210 |

| 21 | L14 (Broadgreen) | £201 |

| 22 | L24 (Speke) | £198 |

| 23 | L36 (Huyton) | £196 |

| 24 | L15 (Wavertree) | £195 |

| 25 | L10 (Aintree) | £191 |

| 26 | L33 (Kirkby) | £176 |

| 27 | L30 (Walton) | £175 |

| 28 | L7 (Edge Hill) | £172 |

| 29 | L32 (Kirkby) | £159 |

| 30 | L21 (Litherland) | £159 |

| 31 | L11 (Norris Green) | £154 |

| 32 | L13 (Old Swan) | £150 |

| 33 | L9 (Walton) | £149 |

| 34 | L27 (Netherley) | £147 |

| 35 | L5 (Everton) | £142 |

| 36 | L6 (Anfield) | £136 |

| 37 | L20 (Bootle) | £130 |

| 38 | L4 (Anfield) | £124 |

Liverpool's price per square foot values show significant variation across different postal districts, with Mossley Hill (L18) commanding the highest at £296 and Anfield (L4) showing the lowest at £124 per square foot. The suburban and sought-after areas typically show higher values, while areas closer to the city center show more varied prices per square foot. These figures reflect the average across all property types and should be considered alongside factors such as building age, condition, and specific location within each postcode.

House Price Growth in Liverpool (%)

Updated February 2025

The data represents the average house price growth over the past five years, calculated using a blended rolling annual comparison of both sold prices and asking prices. These figures should be interpreted with caution, as they reflect average prices across all property types and include both properties currently for sale and those already sold.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | L30 (Walton) | 54.40% |

| 2 | L26 (Halewood) | 53.70% |

| 3 | L10 (Aintree) | 48.90% |

| 4 | L15 (Wavertree) | 48.10% |

| 5 | L38 (Aintree) | 44.80% |

| 6 | L4 (Anfield) | 39.20% |

| 7 | L3 (City Centre) | 38.20% |

| 8 | L22 (Waterloo) | 35.90% |

| 9 | L13 (Old Swan) | 34.00% |

| 10 | L6 (Anfield) | 33.30% |

| 11 | L14 (Broadgreen) | 32.80% |

| 12 | L2 (City Centre) | 31.90% |

| 13 | L9 (Walton) | 29.70% |

| 14 | L21 (Litherland) | 29.20% |

| 15 | L31 (Maghull) | 29.10% |

| 16 | L1 (City Centre) | 28.70% |

| 17 | L16 (Bowring Park) | 28.30% |

| 18 | L11 (Norris Green) | 28.10% |

| 19 | L8 (Toxteth) | 28.10% |

| 20 | L25 (Belle Vale) | 27.30% |

| 21 | L12 (West Derby) | 26.90% |

| 22 | L17 (Sefton Park) | 26.70% |

| 23 | L33 (Kirkby) | 26.30% |

| 24 | L20 (Bootle) | 23.40% |

| 25 | L18 (Mossley Hill) | 23.00% |

| 26 | L19 (Aigburth) | 22.60% |

| 27 | L39 (Ormskirk) | 22.10% |

| 28 | L35 (Rainhill) | 21.80% |

| 29 | L24 (Speke) | 20.40% |

| 30 | L23 (Crosby) | 18.60% |

| 31 | L27 (Netherley) | 16.90% |

| 32 | L34 (Prescot) | 14.30% |

| 33 | L7 (Edge Hill) | 14.30% |

| 34 | L36 (Huyton) | 13.60% |

| 35 | L5 (Everton) | 10.80% |

| 36 | L37 (Formby) | 10.30% |

| 37 | L40 (Burscough) | 8.00% |

| 38 | L32 (Kirkby) | 1.00% |

Liverpool's growth figures show remarkable variation across different areas, with L30 (Walton) leading at 54.40%, followed by L26 (Halewood) at 53.70%. The data reveals particularly strong growth in some traditionally affordable areas, with several postcodes showing growth above 40%. Meanwhile, some established areas like L32 (Kirkby) and L40 (Burscough) show more modest growth rates. These figures should be viewed with some caution as they represent average prices across all property types and include properties 'for sale' and 'sold prices'.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. Next update: April 2025. All data is presented as provided by our sources without adjustments or amendments.

Liverpool Buy-to-Let Rental Market Analysis

For those buying their first rental property, and thinking how much can you charge for rent in Liverpool?

The rental data below gives an indication on the rental income per month and the rental yields landlords can aim to achieve for traditional assured shorthold tenants. This is helpful if you are preparing to become a landlord in the Liverpool area.

Rental Prices in Liverpool (£)

Updated February 2025

The data represents the average weekly rent and calculated monthly equivalent for long-let AST properties in Liverpool. These figures reflect rents across all property types and do not account for differences in property size, number of bedrooms, or short-term lets.

| Rank | Area | Average Weekly Rent | Average Monthly Rent |

|---|---|---|---|

| 1 | L37 (Formby) | £315 | £1,366 |

| 2 | L18 (Mossley Hill) | £297 | £1,288 |

| 3 | L23 (Crosby) | £267 | £1,157 |

| 4 | L40 (Burscough) | £262 | £1,136 |

| 5 | L31 (Maghull) | £249 | £1,080 |

| 6 | L25 (Belle Vale) | £247 | £1,072 |

| 7 | L35 (Rainhill) | £244 | £1,058 |

| 8 | L34 (Prescot) | £235 | £1,018 |

| 9 | L36 (Huyton) | £233 | £1,011 |

| 10 | L33 (Kirkby) | £229 | £994 |

| 11 | L3 (City Centre) | £227 | £985 |

| 12 | L17 (Sefton Park) | £227 | £982 |

| 13 | L19 (Aigburth) | £216 | £935 |

| 14 | L12 (West Derby) | £214 | £927 |

| 15 | L14 (Broadgreen) | £210 | £911 |

| 16 | L22 (Waterloo) | £204 | £885 |

| 17 | L2 (Commercial District) | £201 | £869 |

| 18 | L39 (Ormskirk) | £198 | £858 |

| 19 | L9 (Walton) | £194 | £841 |

| 20 | L13 (Old Swan) | £193 | £836 |

| 21 | L5 (Everton) | £190 | £822 |

| 22 | L4 (Anfield) | £185 | £802 |

| 23 | L20 (Bootle) | £183 | £792 |

| 24 | L21 (Litherland) | £179 | £777 |

| 25 | L8 (Toxteth) | £177 | £765 |

| 26 | L1 (City Centre) | £176 | £764 |

| 27 | L15 (Wavertree) | £158 | £685 |

| 28 | L6 (Anfield) | £152 | £660 |

| 29 | L7 (Edge Hill) | £136 | £590 |

| 30 | L10 (Fazakerley) | Not enough data | Not enough data |

| 31 | L11 (Croxteth) | Not enough data | Not enough data |

| 32 | L16 (Bowring Park) | Not enough data | Not enough data |

| 33 | L24 (Speke) | Not enough data | Not enough data |

| 34 | L26 (Halewood) | Not enough data | Not enough data |

| 35 | L27 (Netherley) | Not enough data | Not enough data |

| 36 | L30 (Bootle) | Not enough data | Not enough data |

| 37 | L32 (Kirkby) | Not enough data | Not enough data |

| 38 | L38 (Aintree) | Not enough data | Not enough data |

Liverpool's rental market shows considerable variation, with Formby (L37) achieving the highest weekly rents at £315 (£1,366 monthly) and Edge Hill (L7) showing more affordable rates at £136 weekly (£590 monthly). The suburban and waterfront areas typically command higher rents, while areas closer to the city center show more varied rental values. Note: These figures represent average rents across all property types, and actual achievable rents can vary significantly based on property size, condition, and specific location within each postcode.

Gross Rental Yields in Liverpool (%)

Updated February 2025

The data represents the average gross rental yield in Liverpool, calculated using a snapshot of current properties for sale and properties for rent. These figures are based on asking prices.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | L7 (Edge Hill) | 7.50% |

| 2 | L6 (Anfield) | 7.10% |

| 3 | L4 (Anfield) | 6.90% |

| 4 | L5 (Everton) | 6.60% |

| 5 | L20 (Bootle) | 6.50% |

| 6 | L15 (Wavertree) | 6.20% |

| 7 | L21 (Litherland) | 6.10% |

| 8 | L8 (Toxteth) | 5.90% |

| 9 | L36 (Huyton) | 5.70% |

| 10 | L9 (Walton) | 5.60% |

| 11 | L14 (Broadgreen) | 5.50% |

| 12 | L33 (Kirkby) | 5.40% |

| 13 | L13 (Old Swan) | 5.30% |

| 14 | L34 (Prescot) | 5.20% |

| 15 | L35 (Rainhill) | 5.10% |

| 16 | L22 (Waterloo) | 5.00% |

| 17 | L1 (City Centre) | 4.90% |

| 18 | L12 (West Derby) | 4.80% |

| 19 | L3 (City Centre) | 4.70% |

| 20 | L19 (Aigburth) | 4.60% |

| 21 | L17 (Sefton Park) | 4.50% |

| 22 | L25 (Belle Vale) | 4.50% |

| 23 | L31 (Maghull) | 4.40% |

| 24 | L40 (Burscough) | 4.40% |

| 25 | L2 (Commercial District) | 4.30% |

| 26 | L23 (Crosby) | 4.20% |

| 27 | L39 (Ormskirk) | 4.20% |

| 28 | L18 (Mossley Hill) | 4.10% |

| 29 | L37 (Formby) | 3.90% |

| 30 | L10 (Fazakerley) | not enough data |

| 31 | L11 (Croxteth) | not enough data |

| 32 | L16 (Bowring Park) | not enough data |

| 33 | L24 (Speke) | not enough data |

| 34 | L26 (Halewood) | not enough data |

| 35 | L27 (Netherley) | not enough data |

| 36 | L30 (Bootle) | not enough data |

| 37 | L32 (Kirkby) | not enough data |

| 38 | L38 (Aintree) | not enough data |

Liverpool's rental yields show notable variation across different postcodes, with Edge Hill (L7) offering the highest yield at 7.50%, followed by Anfield (L6) at 7.10%. The inner-city areas typically show higher yields, while suburban areas like Formby (L37) show lower but still attractive yields at 3.90%. These figures represent gross rental yields calculated from average rents and prices, and investors should note that net yields will be lower after accounting for costs, void periods, and management expenses.

Access our selection of exclusive, high-yielding, off-market property deals and a personal consultant to guide you through your options.

Is Liverpool Rent High?

No, while Liverpool's rental costs vary significantly by area, they generally remain more affordable than many other major cities.

Based on ONS data showing North West median weekly household income at £696 (£36,192 annually), here's how Liverpool's rental costs compare to income:

High Rental Costs

- Formby (L37): 45.3% of income (£315 weekly/£1,366 monthly)

- Mossley Hill (L18): 42.7% of income (£297 weekly/£1,288 monthly)

- Crosby (L23): 38.4% of income (£267 weekly/£1,157 monthly)

Average Rental Costs

- Belle Vale (L25): 35.5% of income (£247 weekly/£1,072 monthly)

- City Centre (L3): 32.6% of income (£227 weekly/£985 monthly)

- Aigburth (L19): 31.0% of income (£216 weekly/£935 monthly)

Low Rental Costs

- Wavertree (L15): 22.7% of income (£158 weekly/£685 monthly)

- Anfield (L6): 21.8% of income (£152 weekly/£660 monthly)

- Edge Hill (L7): 19.5% of income (£136 weekly/£590 monthly)

While suburban locations like Formby and Mossley Hill require over 40% of median household income for rent, many areas remain highly affordable.

The city centre , L25 postcode and L19 postcode typically require 30-35% of median income, while areas undergoing regeneration offer particularly affordable options at under 25% of median income.

Are Liverpool House Prices High?

No, Liverpool's property market offers significantly more accessible price points compared to the wider UK market, with HM Land Registry House Price Index data showing consistent discounts against national averages.

Liverpool's average property price of £188,744 sits 35% below the UK average of £289,707, representing exceptional value.

The asking prices for properties in Liverpool show marked variation between postcodes:

- Premium areas:

- Formby (L37) at £324,464

- Mossley Hill (L18) at £297,434

- Crosby (L23) at £267,566

- Mid-range areas:

- Waterfront (L3) at £227,923

- Belle Vale (L25) at £247,238

- Aigburth (L19) at £216,807

- More affordable areas:

- Anfield (L6) at £152,000

- Edge Hill (L7) at £136,000

- Everton (L5) at £190,000

With median annual earnings in the North West at £36,192 (£696 weekly), this creates a varied affordability picture:

- Lower affordability areas: Formby at 9.0x annual salary

- Average affordability: Belle Vale at 6.8x salary

- Better affordability: Edge Hill at 3.8x salary

This relative affordability, particularly in central areas, has made Liverpool increasingly attractive to both first-time buyers and buy-to-let investors who find themselves priced out of other major cities like Leeds, Nottingham and Southampton, while still maintaining offering excellent growth potential with the significant local government investment.

How Much Deposit to Buy a House in Liverpool?

Assuming a 30% deposit for the average buy-to-let investor, here's an overview of deposit requirements across different Liverpool regions:

North Liverpool

- L4 (Anfield): A buy-to-let investor looking at an average property (£185,000) would need to put down a 30% deposit of £55,500.

- L5 (Everton): In Everton, an investor would need a 30% deposit of £57,000 for an average property (£190,000).

- L9 (Walton): A buy-to-let investor would need a 30% deposit of £58,200 for an average property (£194,000).

South Liverpool

- L18 (Mossley Hill): A buy-to-let investor would need a 30% deposit of £89,100 for an average property (£297,000).

- L17 (Sefton Park): In Sefton Park, an investor would need a 30% deposit of £68,100 for an average property (£227,000).

- L19 (Aigburth): An investor would require a 30% deposit of £64,800 for an average property (£216,000).

City Centre & Waterfront

- L1 (City Centre): A buy-to-let investor would need a 30% deposit of £52,800 for an average property (£176,000).

- L2 (Commercial District): In the Commercial District, an investor would need a 30% deposit of £60,300 for an average property (£201,000).

- L3 (Waterfront): A deposit of £68,100 would be needed for an average property (£227,000).

Surrounding Areas

- L37 (Formby): A buy-to-let investor would need a 30% deposit of £94,500 for an average property (£315,000).

- L23 (Crosby): In Crosby, an investor would need a 30% deposit of £80,100 for an average property (£267,000).

- L25 (Belle Vale): A deposit of £74,100 would be needed for an average property (£247,000).

For those considering how to start a property business, areas like Anfield (L4) and Everton (L5) offer an excellent balance of lower entry prices and the city's highest yields at 6.90% and 6.60% respectively, while maintaining good transport links to the city centre. The L6 and L7 areas also present attractive opportunities with lower deposit requirements while still delivering strong yields above 7%.

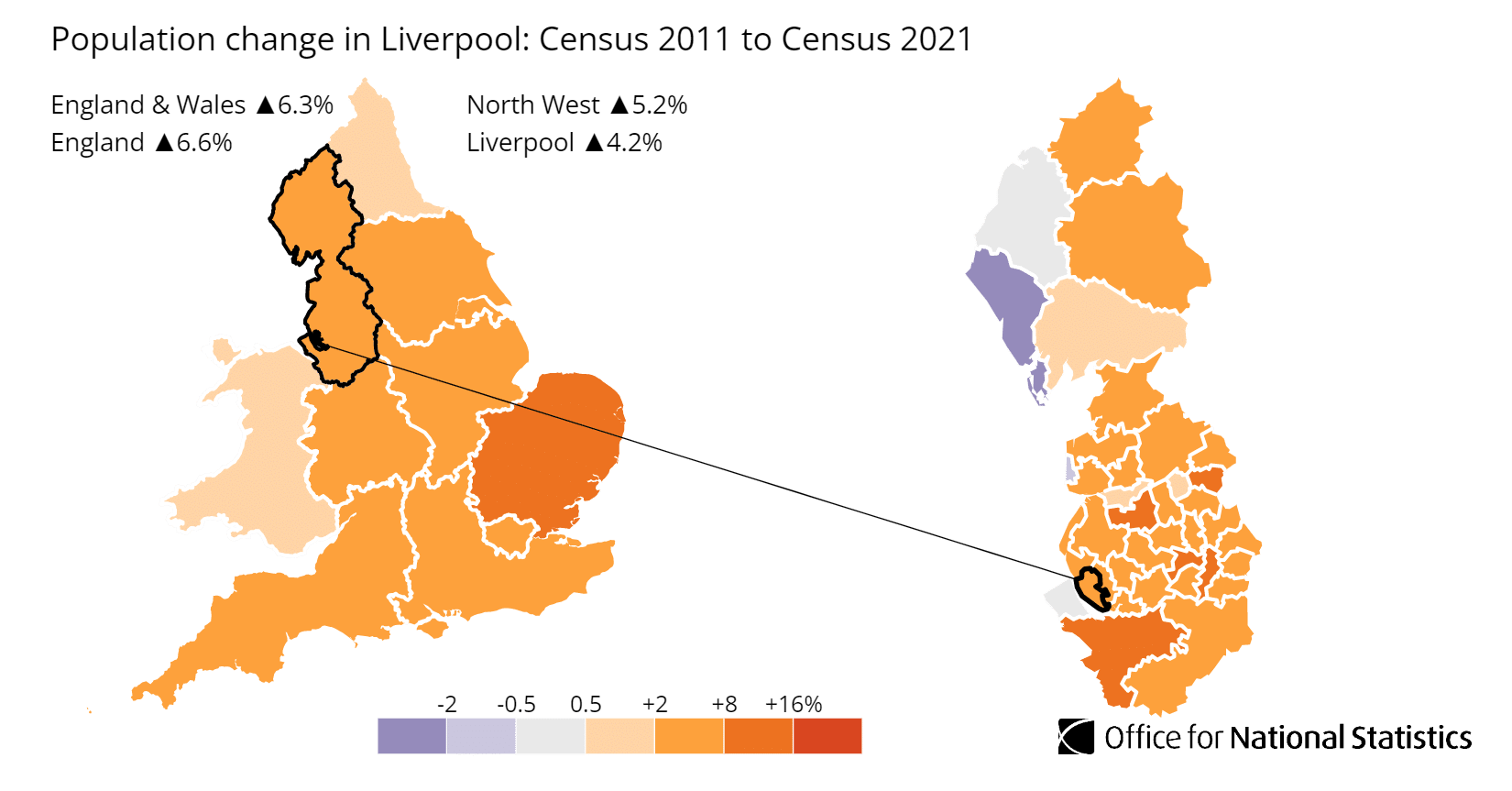

Liverpool Population Growth

The total population of Liverpool was 486,100 (as of the last UK government census in 2021).

Liverpool's population has grown by 4.2%, increasing from 466,400 in 2011.

This growth rate was lower than both the North West region (5.2%) and England's overall growth (6.6%).

The average (median) age in Liverpool remained stable at 35 years between the two censuses. This indicates a notably younger demographic profile compared to both the North West region and England overall, which both had median ages of 40 years.

Notable age-related changes in Liverpool's population between 2011 and 2021 include:

- The number of residents aged 65 to 74 years rose by around 8,400 (a 24.7% rise)

- The 35-49 age group decreased by around 3,500 (a 3.8% reduction)

- The proportion of residents aged 50-64 grew by 1.0 percentage points to 18.0%

Population density in Liverpool has also increased, with the area now home to approximately 31.0 people per football pitch-sized piece of land, up from 29.8 in 2011. This makes Liverpool the second-most densely populated local authority area across the North West (after Manchester).

Of particular interest to landlords, housing tenure has seen significant changes:

- The percentage of households including a couple with dependent children increased from 13.3% to 14.4%

- Single-person households aged under 65 decreased from 27.3% to 24.4%

- Couples without children increased from 11.7% to 13.1%

Below we look at the largest postcode districts by population across Liverpool and the population growth for each.

Population Growth in Liverpool by Postcode District

Population and growth rates by area (2021 Census data)

| Rank | Area | Population at 2021 Census | Population Growth 2011 to 2021 |

|---|---|---|---|

| 1 | L4 (Anfield) | 39,911 | 7% |

| 2 | L36 (Huyton) | 39,896 | 7% |

| 3 | L25 (Belle Vale) | 33,214 | 7% |

| 4 | L9 (Walton) | 32,585 | 6% |

| 5 | L8 (Toxteth) | 32,039 | 7% |

| 6 | L20 (Bootle) | 31,316 | 3% |

| 7 | L12 (West Derby) | 31,095 | 7% |

| 8 | L13 (Old Swan) | 30,949 | 7% |

| 9 | L35 (Rainhill) | 30,730 | 6% |

| 10 | L31 (Maghull) | 30,316 | 3% |

| 11 | L23 (Crosby) | 30,230 | 3% |

| 12 | L15 (Wavertree) | 30,017 | 7% |

| 13 | L39 (Ormskirk) | 28,091 | 8% |

| 14 | L18 (Mossley Hill) | 26,898 | 7% |

| 15 | L14 (Broadgreen) | 25,822 | 7% |

| 16 | L11 (Croxteth) | 25,335 | 7% |

| 17 | L21 (Litherland) | 25,278 | 3% |

| 18 | L19 (Aigburth) | 23,769 | 7% |

| 19 | L6 (Anfield) | 23,668 | 7% |

| 20 | L17 (Sefton Park) | 23,635 | 7% |

| 21 | L37 (Formby) | 23,502 | 3% |

| 22 | L32 (Kirkby) | 20,432 | 7% |

| 23 | L30 (Bootle) | 19,983 | 3% |

| 24 | L40 (Burscough) | 18,091 | 8% |

| 25 | L7 (Edge Hill) | 17,934 | 7% |

| 26 | L3 (City Centre) | 17,396 | 7% |

| 27 | L33 (Kirkby) | 17,005 | 7% |

| 28 | L24 (Speke) | 15,951 | 6% |

| 29 | L26 (Halewood) | 15,149 | 7% |

| 30 | L16 (Bowring Park) | 15,039 | 7% |

| 31 | L10 (Fazakerley) | 14,965 | 5% |

| 32 | L22 (Waterloo) | 13,815 | 3% |

| 33 | L5 (Everton) | 12,865 | 7% |

| 34 | L34 (Prescot) | 12,244 | 7% |

| 35 | L1 (City Centre) | 7,091 | 7% |

| 36 | L27 (Netherley) | 6,415 | 7% |

| 37 | L38 (Aintree) | 2,575 | 3% |

| 38 | L2 (Commercial District) | 935 | 7% |

The population data shows notable variation across Liverpool's postal districts, with Anfield (L4) and Huyton (L36) being the most populous areas, each home to nearly 40,000 residents. Most districts experienced steady growth of 7% over the decade, though some areas like Ormskirk (L39) and Burscough (L40) saw higher growth at 8%, while others such as Bootle (L20) and Formby (L37) had more modest growth at 3%. The population distribution reveals a pattern of higher density in residential areas compared to commercial districts, with L2 (Commercial District) having the smallest residential population at 935. Note: While the postcode district data totals 804,911 residents, Liverpool's total population of 486,100 differs because some postcode districts extend beyond the city's administrative boundaries into neighboring local authorities like Sefton and Knowsley.

Liverpool Landlord Licensing

Buy-to-Let Licensing

For Liverpool buy-to-let landlords with traditional individual or family tenants, there is currently a Selective Licensing scheme in operation. The scheme requires private landlords to obtain a license for each rental property they own within designated areas of Liverpool.

You can see a register of licensed properties in Liverpool here and a map of the areas covered here.

License Fees and Payment Structure

Selective licensing fees are paid in two parts - an initial administration charge and a final payment:

Standard Fees:

- Full property licence fee: £680

- Initial payment: £224.40

- Final payment: £455.60

Discounted Fees:

- New rental property licence: £469

- Initial payment: £225.12

- Final payment: £243.88

Additional Discounts Available:

- Properties with EPC rating C or above: £407

- Multiple flats in same block: £407

- Landlord membership discount: £433

- Combined discounts possible down to £309

Houses of Multiple Occupation Licensing

When is an HMO License Required?

A property needs an HMO license if:

- It's within Liverpool City Council's boundaries

- Has five or more unrelated occupants (including children)

- Contains two or more separate households

- Occupants share bathroom, kitchen or WC facilities

Note: Flats in purpose-built properties with three or more self-contained units may be exempt.

HMO License Fees

Fees are paid in two parts (the first on application and the second on granting of the license) and are based on the number of units (bedrooms):

- Up to 5 units: £1,283 (£466.40 + £816.60)

- 6 units: £1,400 (£466.40 + £933.60)

- 7 units: £1,516 (£466.40 + £1,049.60)

- 8 units: £1,633 (£466.40 + £1,166.60)

- 9 units: £1,750 (£466.40 + £1,283.60)

- 10 units: £1,866 (£466.40 + £1,399.60)

- 10+ units: Additional £58 per unit (maximum £3,500)

Licenses typically last 5 years, but shorter terms may be issued based on:

- Previous unlicensed periods

- Evidence of poor management

- Non-response to notices

- Incorrect planning consents

Article 4 Directions and Conservation Areas

Liverpool has extensive Article 4 directions in place and 36 conservation areas covering 9% of the city, protecting 19,000 properties. In these areas, planning permission is required for changes that would normally fall under permitted development.

Notable Conservation Areas include:

- Albert Dock

- Canning Street

- Castle Street

- Princes Park

- Sefton Park

- Stanley Dock

- Woolton Village

All property alterations in conservation areas and Article 4 zones require planning permission, particularly for:

- Changes to external appearance

- Modifications affecting grounds

- Conversion from C3 (dwelling house) to C4 (HMO)

Landlords should verify current requirements through Liverpool council's online mapping system before making any property changes or conversions.

How to Invest in Buy-to-Let in Liverpool

For properties to buy in Liverpool including:

- Finding off-market properties

- Buy-to-lets

- Buying a holiday let or serviced accommodation

- HMOs (houses of multiple occupation)

- PBSA (purpose built student accommodation)

- and other high yielding opportunities

We have partnered with the best property investment agents we can find for 8+ years.

Here you can get access to the latest investment property opportunities from our network.

For more information about specific areas:

- If you're interested in the highest returns, consider L7 (Edge Hill) with yields of 7.50% or L6 (Anfield) at 7.10%

- For alternative options in the North West with affordable entry prices, check out our guide to the cheapest areas to live in Manchester

- For different opportunities nearby consider exploring buy-to-let in Isle of Man, buy-to-let in Birkenhead and buy-to-let in Blackpool.