Bromley Property Investment: Best Buy-to-Let Areas 2025

One of the greenest parts of London with house prices cheaper than the London average and commute times from only 25 minutes from Bromley South to London Victoria, what's not to like for local residents.

However, buy-to-let in Bromley does present a challenge as local affordability for tenants (and homeowners) is stretched thin based on local average earnings.

In this review of the Bromley property market we look at house price growth, rental yields, population stats and more to see how Bromley performs for landlords compared to the rest of the London housing market.

Article updated: April 2025. Next update: July 2025.

Bromley Buy-to-Let Market Overview 2025

Bromley's property market offers investors an attractive blend of London proximity with prices averaging 8.2% below London's averages. The borough shows significant variation across its postcodes, with premium areas like Chislehurst (BR7) commanding top prices and Penge (SE20) delivering the strongest yields.

- Price range: £395,393 (Penge) to £769,685 (Chislehurst)

- Rental yields: 3.10% to 4.70% across different postcodes

- Rental income: Weekly rents from £360 to £458 (monthly: £1,560 to £1,985)

- Market activity: Highest in Beckenham (46 sales/month) and Orpington (44 sales/month)

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Government Planning and Housing Data

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: April 2025. Next update: July 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Bromley?

Bromley offers a perfect balance of London connectivity and suburban living that's hard to find elsewhere. As London's largest borough, it gives investors plenty of options across different neighbourhoods and price points with prices 8.2% lower than the London average.

The total population of Bromley was 333,000 (as of the last UK government census in 2021) and Bromley's population has grown by 6.7%, increasing from 309,400 in 2011.

Interestingly even though house prices in Bromley have shot up in the years between the census data, the population growth rate was actually lower than the average growth of population across London.

Bromley is notably greener and less crowded than most London boroughs, with large sections within the Metropolitan Green Belt. This green space, combined with excellent schools and solid local amenities, creates consistent rental demand from quality tenants.

Bromley borough includes the town of Bromley and other towns and districts including Beckenham, Chislehurst, Hayes, Orpington, Penge and West Wickham.

Bromley is covered by the main postcodes: BR1, BR2, BR3, BR4, BR5, BR6, BR7, BR8, SE20

With additional postcodes that cross Bromley and other local London Boroughs including:

Bromley Property Market Analysis

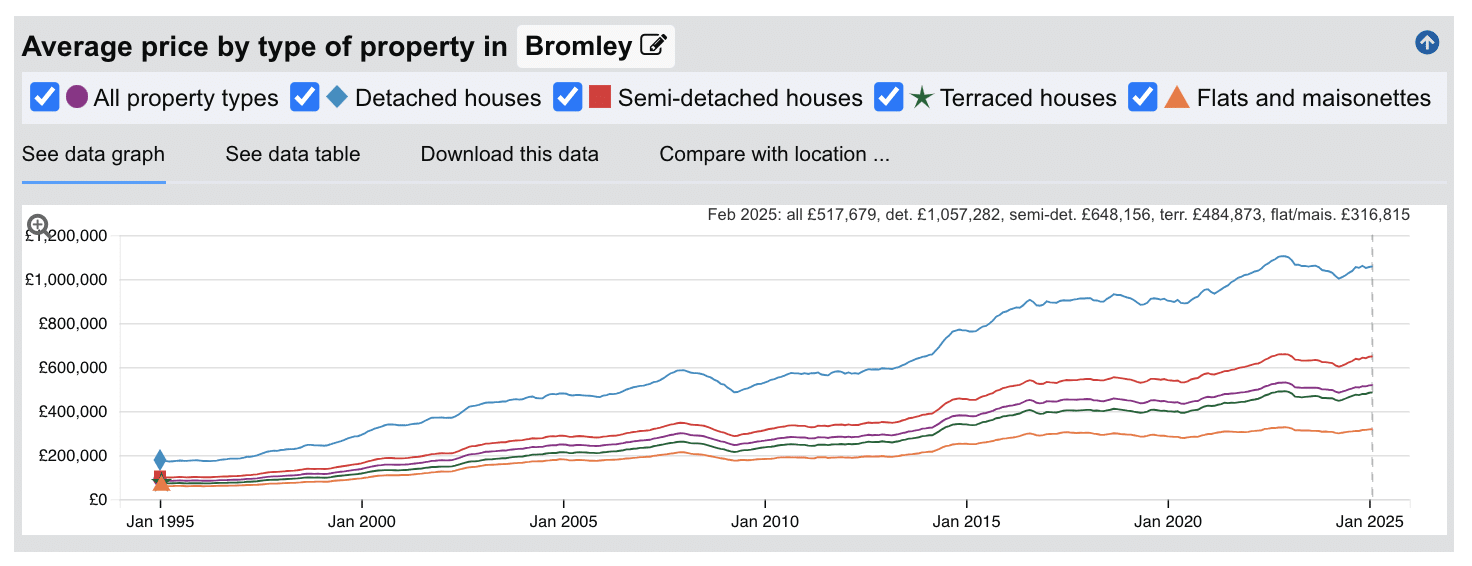

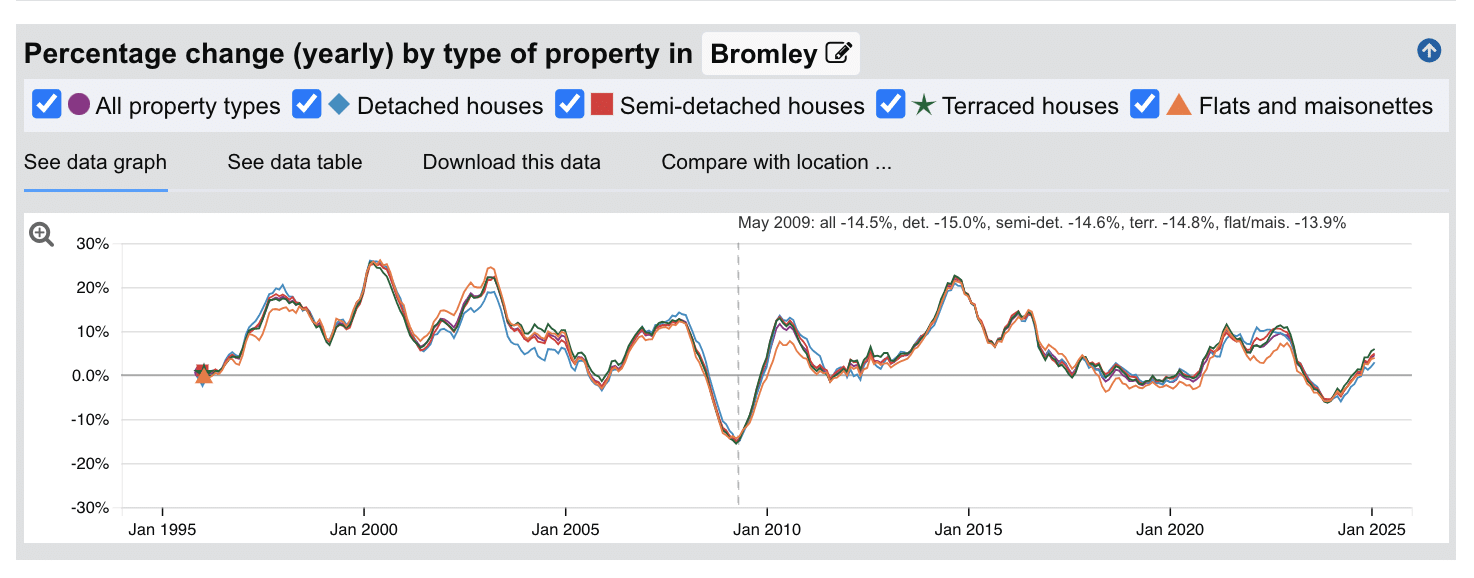

When Was the Last House Price Crash in Bromley?

The last significant property price crash in Bromley occurred during the global financial crisis of 2008-2010 with a price reduction again in 2024.

Source: HM Land Registry House Price Index

Looking at the property data across all types:

- 1995-2000: Steady growth period with annual increases of 5-15%

- 2000-2003: Accelerated growth with peaks reaching 20-25% annual increases

- 2003-2007: Continued strong but somewhat moderated growth

- 2008-2010: Significant house price crash during the financial crisis, with values dropping by approximately 15-20%

- 2010-2013: Recovery period with modest growth resuming

- 2013-2016: Strong growth period with annual increases of 15-20%

- 2016-2019: Period of market adjustment with slight declines or flat growth

- 2020-2022: Despite pandemic uncertainty, strong growth resumed with values increasing

- 2022-2024: Modest correction with small declines across property types

- 2025: Recent data (Feb 2025) shows positive growth across all property types, suggesting market recovery

Unlike some UK regions, Bromley has demonstrated remarkable resilience during market downturns.

This pattern reflects Bromley's enduring appeal as an outer London borough offering excellent connectivity, quality amenities, and desirable living conditions. Even during market corrections, the substantial long-term price appreciation (with detached properties increasing from approximately £175,000 in 1995 to over £1,000,000 by 2025) demonstrates Bromley's strength as a property investment location.

House Prices in Bromley: Sold (£)

The latest sold house price index by the land registry, shows the following average sold house prices across the Bromley local authority area.

Bromley's property prices are below London averages across all categories, with the most significant savings found in flats and maisonettes where sold house prices are 29.3% below the London average. The terraced housing market also offers strong value at 24.0% below London averages, while detached and semi-detached properties show more modest savings at around 8-9% below regional averages. This could indicate stronger value in the terraced and flat (apartments) markets for investors focused on entry price and potential yield as part of their investment property checklist.

Updated April 2025

| Property Type | Bromley Average Price | London Average | Difference |

|---|---|---|---|

| Detached houses | £1,052,813 | £1,146,821 | -8.2% |

| Semi-detached houses | £648,224 | £714,073 | -9.2% |

| Terraced houses | £484,368 | £637,528 | -24.0% |

| Flats and maisonettes | £317,691 | £449,486 | -29.3% |

| All property types | £517,667 | £563,899 | -8.2% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Government Planning and Housing Data

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: April 2025. Next update: July 2025. All data is presented as provided by our sources without adjustments or amendments.

House Prices in Bromley: For Sale Asking Prices (£)

Updated April 2025

The data represents the average asking prices of properties currently listed for sale in Bromley.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | BR7 (Chislehurst) | £769,685 |

| 2 | BR4 (West Wickham) | £714,320 |

| 3 | BR6 (Orpington) | £632,326 |

| 4 | BR2 (Bromley) | £602,097 |

| 5 | BR5 (Orpington) | £536,099 |

| 6 | BR3 (Beckenham) | £535,610 |

| 7 | BR1 (Bromley) | £503,101 |

| 8 | BR8 (Swanley) | £448,962 |

| 9 | SE20 (Penge) | £395,393 |

Chislehurst (BR7) commanding the highest prices at £769,685, nearly double the cost of properties in Penge (SE20) at £395,393. West Wickham (BR4) follows as the second most expensive area at £714,320, while the Orpington districts (BR6 and BR5) show a notable price difference between them. Central Bromley areas (BR1 and BR2) demonstrate the borough's price variance, with BR2 commanding nearly £100,000 more on average than BR1. These figures represent average asking prices across all property types, and actual achievable prices may vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Bromley (£)

Updated April 2025

The data represents the average sold price per square foot of properties actually sold in Bromley over the past 18 months.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | BR7 (Chislehurst) | £570 |

| 2 | SE20 (Penge) | £556 |

| 3 | BR3 (Beckenham) | £550 |

| 4 | BR6 (Orpington) | £537 |

| 5 | BR4 (West Wickham) | £536 |

| 6 | BR2 (Bromley) | £535 |

| 7 | BR1 (Bromley) | £513 |

| 8 | BR5 (Orpington) | £497 |

| 9 | BR8 (Swanley) | £433 |

Bromley's price per square foot values show notable variation across the borough, with Chislehurst (BR7) commanding the highest at £570 and Penge (SE20) following surprisingly close at £556 per square foot. The affluent area of Beckenham (BR3) shows strong values at £550, while most central and western parts of the borough maintain values in the £513-537 range. Swanley (BR8) offers the most affordable space at £433 per square foot, significantly below the borough average. These figures reflect the average across all property types and should be considered alongside factors such as building age, condition, and specific location within each postcode. The high value in Penge (SE20) may reflect recent regeneration with higher priced, smaller new build developments.

House Price Growth in Bromley (%)

Updated April 2025

The data represents the average house price growth over the past five years, calculated using a blended rolling annual comparison of both sold prices and asking prices.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | BR2 (Bromley) | 20.00% |

| 2 | BR8 (Swanley) | 18.90% |

| 3 | BR6 (Orpington) | 17.30% |

| 4 | BR3 (Beckenham) | 16.80% |

| 5 | BR4 (West Wickham) | 16.30% |

| 6 | BR1 (Bromley) | 15.70% |

| 7 | BR5 (Orpington) | 14.90% |

| 8 | SE20 (Penge) | 10.10% |

| 9 | BR7 (Chislehurst) | 4.00% |

Bromley's growth figures show notable variation across different areas, with BR2 (Bromley) leading at 20.00%, followed closely by BR8 (Swanley) at 18.90%. These strong performers demonstrate the continued demand for property in both the central Bromley area and the more affordable outer regions. Mid-range growth is seen across most of the borough, with BR6 (Orpington), BR3 (Beckenham), BR4 (West Wickham), and BR1 (Bromley) all showing solid five-year growth between 15-17%. These figures should be viewed with some caution as they represent average prices across all property types and include both properties 'for sale' and 'sold prices'. The significantly lower growth rate in premium Chislehurst (BR7) at just 4.00% may reflect its already high base values and more mature market, while Penge (SE20) shows moderate growth at 10.10%, potentially offering value opportunities for investors seeking areas with room for further appreciation.

Average Monthly Property Sales in Bromley

Updated April 2025

The data represents the average number of residential property sales per month across Bromley's postcode districts, based on transactions recorded over the past 3 months.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | BR3 (Beckenham) | 46 |

| 2 | BR1 (Bromley) | 42 |

| 3 | BR6 (Orpington) | 44 |

| 4 | BR5 (Orpington) | 33 |

| 5 | SE20 (Penge) | 20 |

| 6 | BR8 (Swanley) | 18 |

| 7 | BR7 (Chislehurst) | 16 |

| 8 | BR2 (Bromley) | 16 |

| 9 | BR4 (West Wickham) | 16 |

Bromley's property market shows significant variation in sales activity across different areas. Beckenham (BR3) leads with the highest transaction volume at 46 sales per month, closely followed by Orpington (BR6) with 44 and Bromley Central (BR1) with 42 monthly sales. These three areas account for nearly half of all monthly transactions across the borough, indicating their higher liquidity and stronger market activity. The mid-volume areas of Orpington (BR5) see moderate activity with 33 sales per month, while the remaining districts show considerably lower transaction volumes between 16-20 sales per month. Lower transaction volumes in areas like West Wickham (BR4), Bromley (BR2), and Chislehurst (BR7) may reflect their smaller geographic size, lower housing density, or higher property retention rates among homeowners. For investors, areas with higher transaction volumes typically offer greater market liquidity, potentially making entry and exit strategies more flexible.

Planning Applications in Bromley

Updated April 2025

The data represents the average number of planning applications submitted per month in each postcode district, along with the percentage of applications that receive approval.

| Rank | Area | Monthly Applications | Success Rate |

|---|---|---|---|

| 1 | BR6 (Orpington) | 58 | 79% |

| 2 | BR1 (Bromley) | 51 | 73% |

| 3 | BR2 (Bromley) | 48 | 77% |

| 4 | BR3 (Beckenham) | 48 | 81% |

| 5 | BR5 (Orpington) | 40 | 76% |

| 6 | BR7 (Chislehurst) | 24 | 80% |

| 7 | BR4 (West Wickham) | 23 | 84% |

| 8 | BR8 (Swanley) | 16 | 83% |

| 9 | SE20 (Penge) | 11 | 72% |

Planning application data reveals significant development activity across Bromley, with Orpington (BR6) leading at 58 applications per month, followed by Bromley Central (BR1) with 51. Success rates vary considerably, with West Wickham (BR4) achieving the highest approval rate at 84%, while Penge (SE20) sees the lowest at 72%. For investors, areas with both high application volumes and success rates may indicate stronger development momentum and potential for area improvement. The consistently high approval rates across all districts (72-84%) suggest Bromley Council maintains a generally favorable approach to development applications, which could benefit investors looking to add value through planning enhancements.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Government Planning and Housing Data

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: April 2025. Next update: July 2025. All data is presented as provided by our sources without adjustments or amendments.

Bromley Rental Market Analysis

For those buying their first rental property, and thinking how much can you charge for rent in Bromley?

The rental data below gives an indication on the rental income per month and the rental yields landlords can aim to achieve for traditional assured shorthold tenants. This is helpful if you are preparing to become a landlord in the London Borough of Bromley.

Average Rent in Bromley (£)

Updated April 2025

The data represents the average monthly rent for long-let AST properties in Bromley. These figures reflect rents across all property types and do not account for differences in property size, number of bedrooms, or short-term lets.

| Rank | Area | Average Weekly Rent | Average Monthly Rent |

|---|---|---|---|

| 1 | BR7 (Chislehurst) | £458 | £1,985 |

| 2 | BR6 (Orpington) | £450 | £1,950 |

| 3 | BR5 (Orpington) | £438 | £1,898 |

| 4 | BR2 (Bromley) | £416 | £1,803 |

| 5 | BR1 (Bromley) | £396 | £1,716 |

| 6 | BR8 (Swanley) | £393 | £1,703 |

| 7 | BR3 (Beckenham) | £392 | £1,699 |

| 8 | SE20 (Penge) | £360 | £1,560 |

| 9 | BR4 (West Wickham) | no data | no data |

Bromley's rental market shows clear price segmentation across different areas, with Chislehurst (BR7) achieving the highest average weekly rents at £458 (£1,985 monthly) and both Orpington areas (BR6 and BR5) following with premium rental rates at £450 and £438 weekly respectively. The central Bromley areas (BR2 and BR1) command mid-range rents, while Penge (SE20) offers more affordable options at £360 weekly (£1,560 monthly). These figures represent average rents across all property types, from studio apartments to larger houses, and actual achievable rents can vary significantly based on property size, condition, and specific location within each postcode. West Wickham (BR4) shows insufficient data, due to limited rental listings available on the market at the time.

Gross Rental Yields in Bromley (%)

Updated April 2025

The data represents the average gross rental yield in Bromley, calculated using a snapshot of current properties for sale and properties for rent. These figures are based on asking prices.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | SE20 (Penge) | 4.70% |

| 2 | BR8 (Swanley) | 4.60% |

| 3 | BR5 (Orpington) | 4.20% |

| 4 | BR1 (Bromley) | 4.10% |

| 5 | BR3 (Beckenham) | 3.80% |

| 6 | BR6 (Orpington) | 3.70% |

| 7 | BR2 (Bromley) | 3.60% |

| 8 | BR7 (Chislehurst) | 3.10% |

| 9 | BR4 (West Wickham) | no data |

Bromley's rental yields show notable variation across different postcodes, with Penge (SE20) offering the highest yield at 4.70%, followed closely by Swanley (BR8) at 4.60%. These areas typically have more accessible property prices while maintaining strong rental demand. Orpington (BR5) also offers attractive yields at 4.20%, while central Bromley (BR1) delivers a solid 4.10%. Premium areas like Chislehurst (BR7) show lower yields due to their higher purchase prices. These figures represent gross rental yields calculated from average rents and prices, and investors should note that net yields will be lower after accounting for costs, void periods, and management expenses. West Wickham (BR4) shows insufficient data due to very few rental properties currently available on the market.

Access our selection of exclusive, high-yielding, off-market property deals and a personal consultant to guide you through your options.

Is Bromley Rent High?

Yes, Bromley's rental costs represent a substantial financial burden for residents, consuming a significant percentage of local incomes.

Average rent in Bromley costs from 49.43% to 62.89% as a percentage of earnings based on the ONS earnings data showing Bromley's mean annual income at £37,871 (slightly below the UK mean of £38,224 and significantly below the London mean of £56,752).

In Chislehurst (BR7), which has Bromley's highest weekly rents at £458 (£1,985 monthly), residents who earn an 'average income' would need to commit 62.89% of their gross mean income to rent.

The situation is similar in Orpington (BR6), where weekly rents of £450 (£1,950 monthly) would require 61.79% of the mean income.

Even in more affordable areas like Penge (SE20), where weekly rents average £360 (£1,560 monthly), residents still need to commit 49.43% of mean income to rent. Central areas like Bromley (BR1) show consistently high rental rates at £396 per week (£1,716 monthly), requiring around 54.37% of gross mean income.

The rental-to-income ratio in Bromley highlights the "affordability gap" that exists across outer London boroughs, where rental costs have risen faster than wages. With most areas requiring between 49-63% of gross mean income for rent (before tax, utilities, and other living expenses) the rental market presents significant challenges for tenants.

Buy-to-Let Considerations

Are Bromley House Prices High?

Yes, Bromley's property market shows elevated prices compared to national averages and significant affordability challenges for local residents (both first time buyers and buy-to-let landlords), although it does offer relative value within the London context.

Bromley's average property price of £517,667 sits 78.7% above the UK average of £289,707, demonstrating its position as a premium outer London borough, but also representing an 8.2% discount compared to the London average of £563,899.

The asking prices for properties in Bromley currently on the market vary considerably across postcodes, from Chislehurst (BR7) at £769,685 and West Wickham (BR4) at £714,320, down to more affordable areas like Penge (SE20) at £395,393 and Swanley (BR8) at £448,962.

With median annual earnings in Bromley at £34,072 (12.9% higher than the UK average), even Bromley's most affordable area (Penge) requires around 11.6 times annual salary, while the more affluent suburbs like Chislehurst exceed 22.6 times the local median wage. Mean earnings in Bromley are £37,871, which is slightly below the UK mean of £38,224 and substantially below the London mean of £56,752. This earnings gap helps explain why affordability remains a critical issue despite Bromley's relatively high median income.

Source: ONS Earnings and Hours Worked dataset

Even traditionally more accessible areas like Bromley Central (BR1), where prices average £503,101, still require around 14.8 times the local median salary - far exceeding typical mortgage lending limits of 4-4.5 times household income.

For buy-to-let investors, these high price-to-income ratios typically translate to lower rental yields compared to other parts of the UK, yet Bromley still represents a value alternative for those priced out of inner London, offering a suburban lifestyle with direct access to central London within 20-30 minutes.

How Much Deposit to Buy a House in Bromley?

Assuming a 30% deposit for the average buy-to-let investor, here's an overview of deposit requirements across different Bromley regions:

Central Bromley

- BR1 (Bromley): A buy-to-let investor looking at an average property would need to put down a 30% deposit of £150,930.

- BR2 (Bromley): In this area, an investor would need a 30% deposit of £180,629 for an average property.

East Bromley

- BR5 (Orpington): A buy-to-let investor would need a 30% deposit of £160,830 for an average property.

- BR6 (Orpington): In the broader Orpington area, an investor would need a 30% deposit of £189,698 for an average property.

West Bromley

- BR3 (Beckenham): A buy-to-let investor would need a 30% deposit of £160,683 for an average property.

- BR4 (West Wickham): An investor would require a 30% deposit of £214,296 for an average property.

- BR7 (Chislehurst): For an average property in Chislehurst, a deposit of £230,908 would be needed.

Outer Areas

- BR8 (Swanley): A buy-to-let investor would need a 30% deposit of £134,689 for an average property.

- SE20 (Penge): In Penge, an investor would need a 30% deposit of £118,618 for an average property.

If you’re new to property, or just starting out through a property training course, areas like Penge (SE20) and Swanley (BR8) offer an excellent balance of affordable entry prices.

How to Invest in Buy-to-Let in Bromley

For properties to buy in Bromley including:

- Finding off-market properties

- Buy-to-lets

- Buying a Holiday let or investing in serviced accommodation

- HMOs (houses of multiple occupation)

- PBSA (purpose built student accommodation)

- and other high yielding opportunities

We have partnered with the best property investment agents we can find for 8+ years.

Here you can get access to the latest investment property opportunities from our network.

For more information about specific areas:

- If you're interested in the highest rental returns in Bromley, consider SE20 (Penge) with yields of 4.70% and BR8 (Swanley) at 4.60%

- For alternative look at the local housing market, with affordable entry prices, check out our guide to the cheapest areas to live in London.

- For different opportunities further afield consider exploring buy-to-let in Brighton or buy-to-let in Luton.